Lancaster County Va Real Estate Assessment

Lancaster County, VA Property Tax Calculator 2025-2026

Calculate Your Lancaster County Property Taxes Lancaster County Tax Information How are Property Taxes Calculated in Lancaster County? Property taxes in Lancaster County, Virginia are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.47% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/virginia/lancaster-county

County Info

Our real estate tax rate is $.63 per $100 of assessed value. The ... © 2026. Lancaster By the Bay Chamber. Privacy & Terms | Powered By : Chamber ...

https://www.lancasterva.com/county-infoLancaster County, Virginia

- Research County Ordinances & Land Development Codes? - Live Stream Board Meetings and View Meeting Documents? - View GIS Maps and Parcel Data? - Make Tax Payments Online? - Pay Court Fees Online? - Look Up Real Estate and Personal Property Taxes Payment History?

https://www.lancova.com/

Lancaster approves FY26 budget without tax increase ...

Lancaster Supervisors approved the county's $46.8 million FY26 budget without increasing the real estate property ... © Copyright 2026 News on the ...

https://www.newsontheneck.com/news/lancaster-approves-fy26-budget-without-tax-increase-makes-move-on-borrowing-plan/article_afd05128-44b9-4be9-833f-043f09a78add.htmlLancaster county officials are discussing a proposal to increase property taxes by 10 percent. | WPMT FOX43 | Facebook

Perry Fischer your exactly right, it seems like every year they increase taxes.Their not worried about costs, they’ll just increase taxes. maybe those in office are making to much money...

https://www.facebook.com/fox43news/posts/lancaster-county-officials-are-discussing-a-proposal-to-increase-property-taxes-/1369665834745363/

Home | County of Lancaster, Office of Recorder of Deeds

Bulletin Board Effective Immediately Pursuant to Act 45 of 2025 signed by Governor Shapiro on 11/13/2025, the JCP fee has increased to from $40.25 to $41.25. As of October 1, 2025 there is a 25¢ per page fee for our staff to print trusts and other supporting documents.

https://www.lancasterdeeds.com/

PUBLIC NOTICES

The reassessment will be effective January 1, 2026 and affect taxes due. November 5, 2026. The reassessment process has been undertaken by ...

https://rrecord.com/wp-content/uploads/2025/12/Public-Notices.pdfProperty Assessment | Lancaster County, PA - Official Website

Property Assessment The Lancaster County Property Assessment Office assesses real estate within the county for the local property tax levy. County government, 17 school districts, and most of the 60 municipalities in the county levy a property tax. For most, the property tax is their principal source of revenue.

https://co.lancaster.pa.us/154/Property-Assessment

Lancaster County, PA Government is... - City of Lancaster, PA | Facebook

Lancaster County, PA Government is conducting a countywide property reassessment for 2027. This is a County-led process, and we’re sharing this information as a courtesy to our residents. What You Need to Know: - The reassessment process begins in 2025. - County assessors may visit properties for exterior-only inspections.

https://www.facebook.com/CityOfLancasterPA/posts/lancaster-county-pa-government-is-conducting-a-countywide-property-reassessment-/1046097867562459/

VamaNet Sunset Redirect

For questions during the transition, please contact [email protected]...

https://info.vgsi.com/vamanet-migration-2025

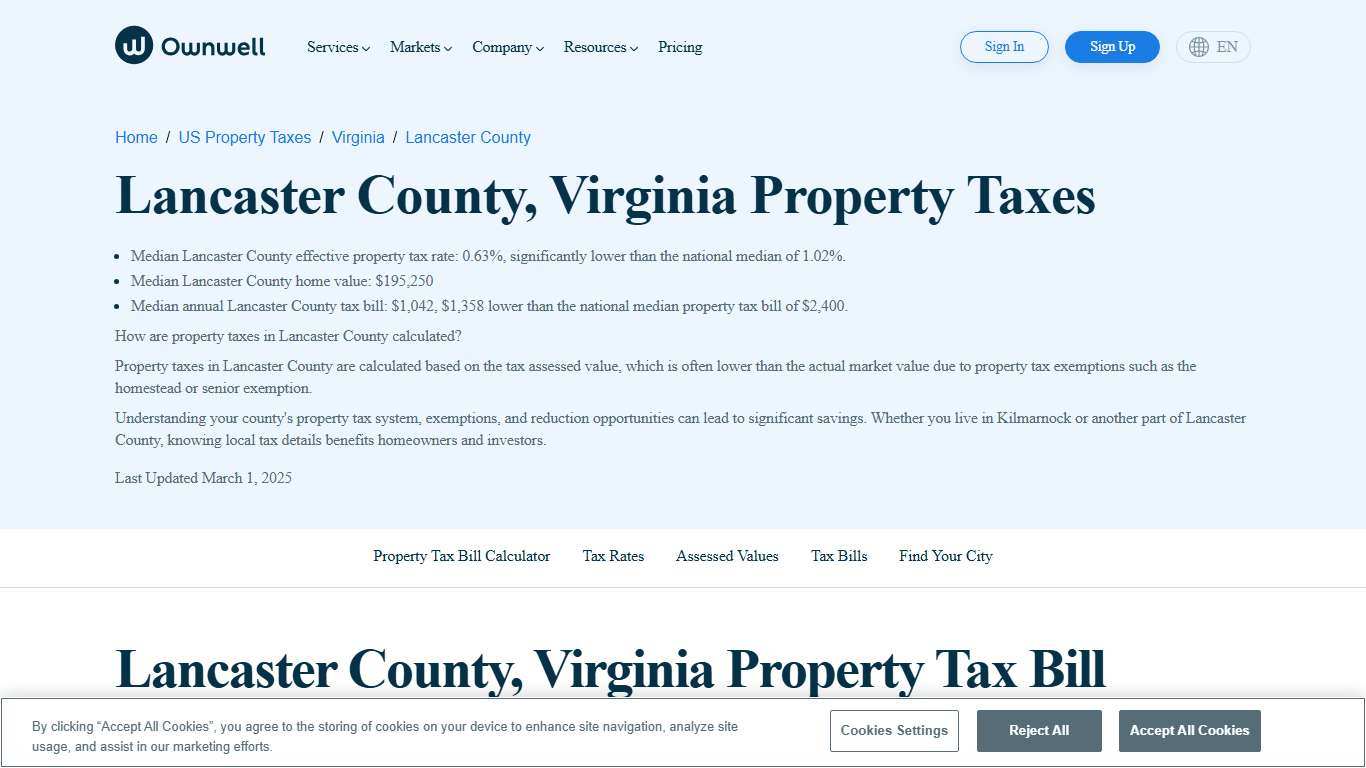

Lancaster County, Virginia Property Taxes - Ownwell

Lancaster County, Virginia Property Taxes Median Lancaster County effective property tax rate: 0.63%, significantly lower than the national median of 1.02%. Median Lancaster County home value: $195,250 Median annual Lancaster County tax bill: $1,042, $1,358 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/virginia/lancaster-county

Lancaster County, Virginia

Most files listed on this page, with the exception of specialized GIS map layers, can be viewed using software that can be obtained elsewhere on the world wide web at no cost.

https://www.lancova.com/page3.asp?pageID=47

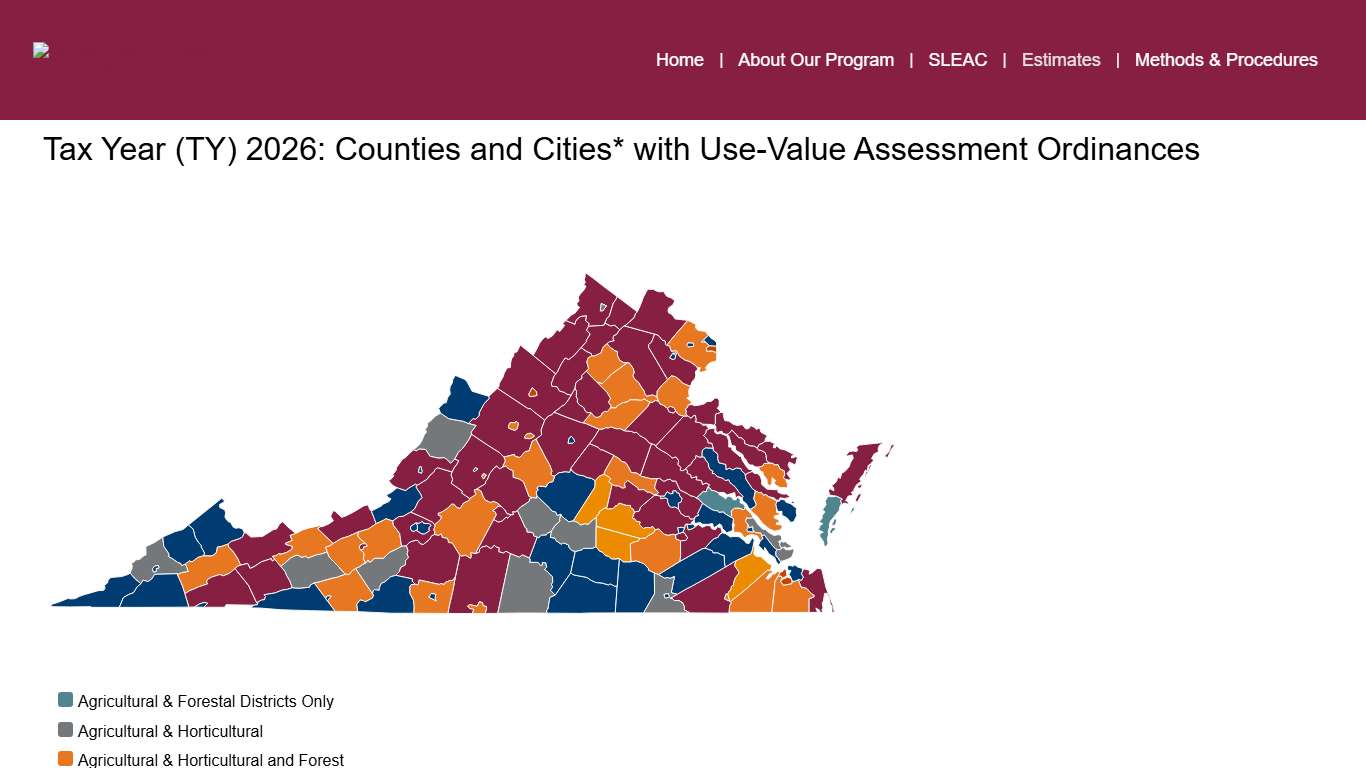

Estimates – Virginia Land Use Value Assessment

Tax Year (TY) 2026: Counties and Cities* with Use-Value Assessment Ordinances *Counties/Cities are identified from annual use-value reports and may differ from actual implementation. Contact government officials in each county/city for the current use-value implementation. Not all participating cities are identified on this map.

https://luva.aaec.vt.edu/estimates/

Real Estate Appraisal in Lancaster County, Virginia 8045801252

As licensed appraisers, we possess the training and competence to produce the type of reliable property value opinions that banks and top lending institutions need for home loans. With years of experience under our belt, we're prepared to accept assignments pertaining to practically any type of real estate.

https://janabbottappraisals.appraiserxsites.com/

Home | County of Lancaster, Office of Recorder of Deeds

Bulletin Board Effective Immediately Pursuant to Act 45 of 2025 signed by Governor Shapiro on 11/13/2025, the JCP fee has increased to from $40.25 to $41.25. As of October 1, 2025 there is a 25¢ per page fee for our staff to print trusts and other supporting documents.

https://www.lancasterdeeds.com/

Tax Information – Strasburg Borough

**NEW FOR 2026** You can no longer pay your LANCASTER COUNTY & MUNICIPAL REAL ESTATE TAX BILL at the Strasburg Borough Office. Please see your bill for payment options. Real Estate Tax Real estate tax is based on the current assessed value of your property multiplied by the current millage rate.

https://strasburgboro.org/departments/real-estate-taxes/